Participation in this project is prohibited for a US person. Please seek legal and tax advice.

Disclaimer: Certain statements in this whitepaper constitute forward-looking statements. Such forward-looking statements, including the intended actions and performance objectives of the Company, involve known and unknown risks, uncertainties, and other important factors that could cause the actual results of the Company to differ materially from any future results expressed or implied by such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. No representation or warranty is made as to future performance or such forward-looking statements.

Last updated 12/30/2022 - to access older versions, please contact the team

1. Introduction2. Definitions2.1 What do LPs want?2.2 What do LTs want?3. Auctioning Liquidity3.1 How is it going to work?4. What is Archimedes?4.1 The Liquidity Provider (LP) Side4.1.1 What is lvUSD?4.1.2 Is there a time limit on the loans and what happens after the loan expires?4.1.3 How does the LP rewards work?4.1.4 What is the APY on the 3CRV/lvUSD pool? How do you protect ARCH and its utility?4.1.5 How to ensure that LPs can exit the pool?4.1.6 How does LP know which strategies are included?4.1.7 How is leverage allocated to different strategies?4.2 The Leverage Takers (LT) Side4.2.1 What do LTs provide to the protocol?4.2.2 What is sent out of Archimedes back to LTs wallet?4.2.3 How does the auction work?4.2.4 What is the difference between strategy and position?4.2.5 What is “force close”?4.2.6 What are the protocol fees?4.2.7 Why NFT?4.2.8 Claiming Rewards

1. Introduction

Decentralized Finance (DeFi) has the potential to provide a more transparent and secure platform for users. However, it has been plagued by deadlocks and conflicts that have limited its growth and adoption. Archimedes is a DeFi infrastructure lego block that resolves these DeFi deadlocks.

In the current DeFi landscape, users are faced with the dilemma when choosing solutions. On the one hand, they can choose to open positions within Centralized Finance (CeFi) solutions lacking transparency while getting exposure to unknown risks. On the other hand, they can opt to participate in projects that employ win-lose relationships among their stakeholders, where one party's success is dependent on the failure of another. In the lending and borrowing space, among other examples, this presents itself through protocols focusing on liquidating users as their main revenue source. As a consequence of this:

- There are very few long term investment options

- Opposing sides are fighting each other. It is hard to get different stakeholders to build together, such as whales vs. shrimps or protocol vs. users

- Most users end up losing

This dynamic creates a number of challenges, including a lack of long-term investment options and difficulties in getting different stakeholders to work together, such as whales versus shrimps or protocols versus users. As a result, many users end up losing.

Despite this, DeFi users are constantly seeking sustainable solutions, but they often struggle to find them due to these challenges. However, DeFi has the unique advantage of being built on an open blockchain, which offers potential for greater transparency compared to traditional financial systems.

But currently in DeFi, there is a dichotomy problem with apparent unmatched liquidity.

A large portion of stablecoin liquidity sits unused in Automated Market Makers, or AMMs, such as Curve. Most of this liquidity does not participate in economic activity, e.g., trading. On the other hand, power users and experts in the ecosystem often struggle to access the volume of liquidity to meet their demand, as it appears to be scarce and expensive.

Additionally, Liquidity Providers (LPs) receive 90% or more of the APY from token emissions (like: CRV), not from "Real Yield", while other investors want to borrow this liquidity, but don’t have access to it.

This situation poses an issue of capital efficiency and sustainability.

Real, on-chain transparency combined with long term thinking are the missing pieces that solve these problems. And Archimedes uses those principles to help solve the issues for its users.

Archimedes enables liquidity providers to auction their liquidity to the highest bidders wanting to borrow from them. We then enable these savvy users and bidders to leverage existing assets that represent optimism on the direction of the ecosystem, such as speculating about the rise of stablecoin yields or the extra volatility of ETH.

2. Definitions

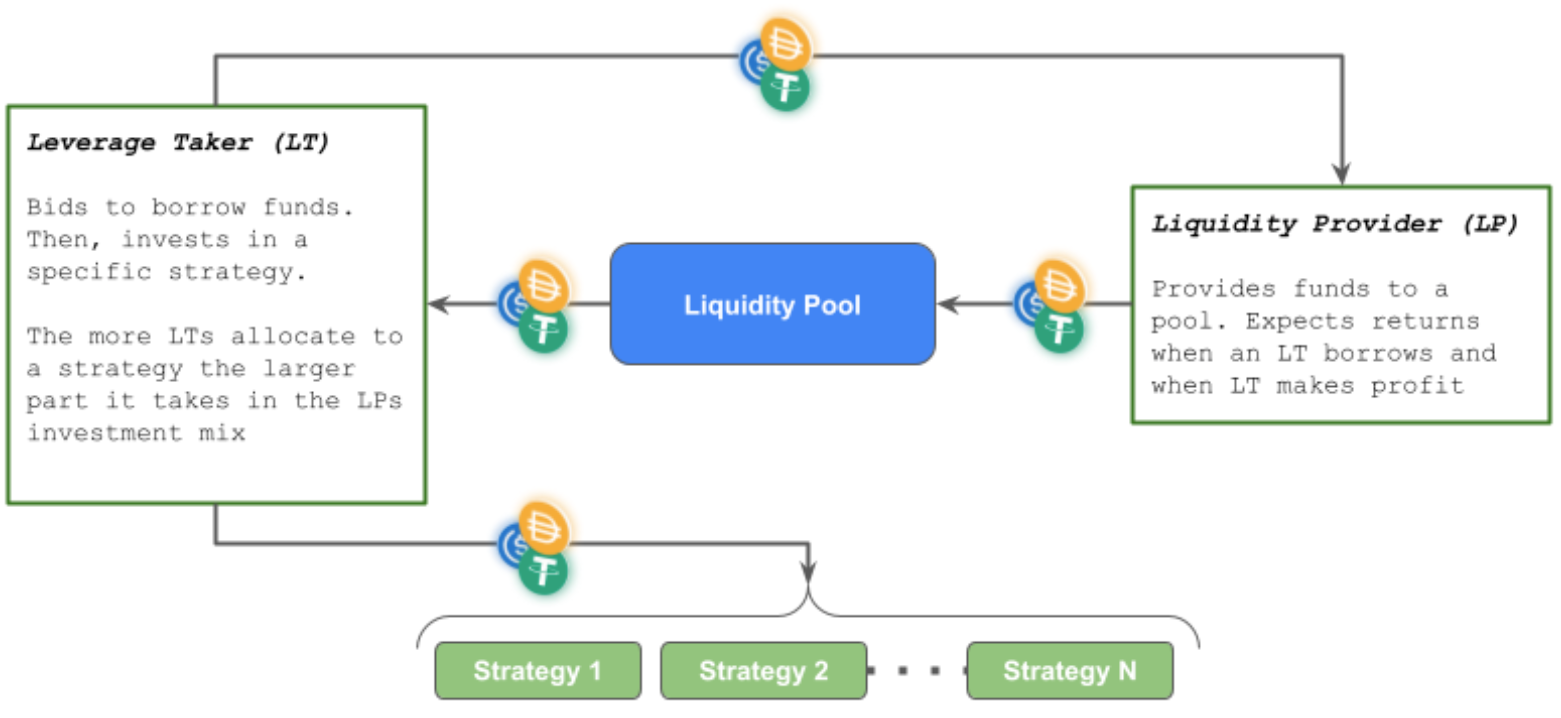

Before we delve into the technical solutions, we need to better understand the two players involved. We refer to the user who provides funds as the Liquidity Provider (LP), and the user who borrows them as the Leverage Taker (LT).

2.1 What do LPs want?

LPs want low risk to yield reward ratio with transparency. CeFi has no transparency and this is why many users go to DeFi. Thus, many Stablecoin LPs earn money through an AMM, often Curve. However, the size of return they earn (APY) is strongly tied to CRV emission and not trade volume, which causes scalability problems:

- The amount of CRV allocated to pools changes frequently, forcing investors to move their funds between different pools to earn the most return

- The size of their investment in a single pool is limited by the amount of CRV allocated to this pool. So investors must divide large investments among multiple pools or risk reducing their earnings

- For the same reason, CRV emission poses a global cap on Curve's ability to scale

Instead of matching LPs' liquidity with parties that can generate the most value from it such as borrowers, their liquidity is heavily commoditized. In the current system, liquidity supply far exceeds demand.

Another challenge LPs face is how to choose the best strategy.

Investors can make their own decisions or trust experts, but there is no way to "ask the market" for the best approach. Most LPs adhere to similar strategies, and only a small number of very nimble LPs capitalize on changes in the market. Instead, most LPs take a long time to adjust and miss out on the "first mover advantage''.

2.2 What do LTs want?

For Leverage Takers (LTs), it is difficult to take a long-term position on the ecosystem (such as stablecoin future APY, market volatility, and ETH direction, etc.). These are the main reasons why:

- The proper instruments may not exist

- Or, the fee structure makes it uneconomical or unpredictable

- Or, predatory mechanisms profit from liquidations. In these protocols, LTs are easily liquidated and heavily penalized

Many protocols create a competitive environment where one side must lose for the other to profit. Meanwhile, the protocol revenue is based on this dynamic, so it encourages frequent liquidation events. This creates a relationship where one side's gain is the other side's loss, and the more frequent and devastating the losses the more the protocol profits.

These are the reasons why, virtually only adversarial short-term positions are available.

LTs are looking for a predictable and more "friendly" instrument where the incentives of both borrowers and lenders are aligned. They want to capitalize on their long-term predictions without constantly worrying about variable fees, penalties, and liquidations.

3. Auctioning Liquidity

We "ask the market" what the fair value price of Leverage should be through Auctioning liquidity. This approach allows us to provide liquidity to LTs with the highest conviction in their ability to generate yield, letting the market make the decision instead of individuals.

LTs bid for access to leverage, and the highest bidders receive the loan. They pay LPs upfront for the privilege of using the leverage for a predefined period of time. To make it predictable and transparent for LTs, there is no ongoing interest on the loan. LTs pay upfront to access funds and share some of the ongoing profits with the protocol treasury which can be used to reward LPs.

At scale, in the future LPs yield will come directly from real activity: LTs accessing LPs funds, rather than from unrelated token emissions. Another benefit is that LPs invest in a diversified portfolio determined by "the market" rather than a committee. LTs "put their money where their mouth is" and collectively determine the investment mix.

Here is the general idea (specific implementation will have it’s own variations):

3.1 How is it going to work?

This general idea raises many questions:

- How do we auction liquidity?

- For how long do LTs receive the liquidity?

- Can LTs exit before the loan expires?

- How do we ensure that LTs pay back the loan?

- How do LTs and LPs agree upfront on which strategies are fair play?

- How do LPs exit completely?

- How does the LP rewards mechanism work?

- How do we design this liquidity pool?

- What happens after the loan expires?

Archimedes is a collection of technical infrastructure tools designed to answer these questions.

4. What is Archimedes?

To understand the technical components, we'll explain it from the perspective of the LP and then the LT.

4.1 The Liquidity Provider (LP) Side

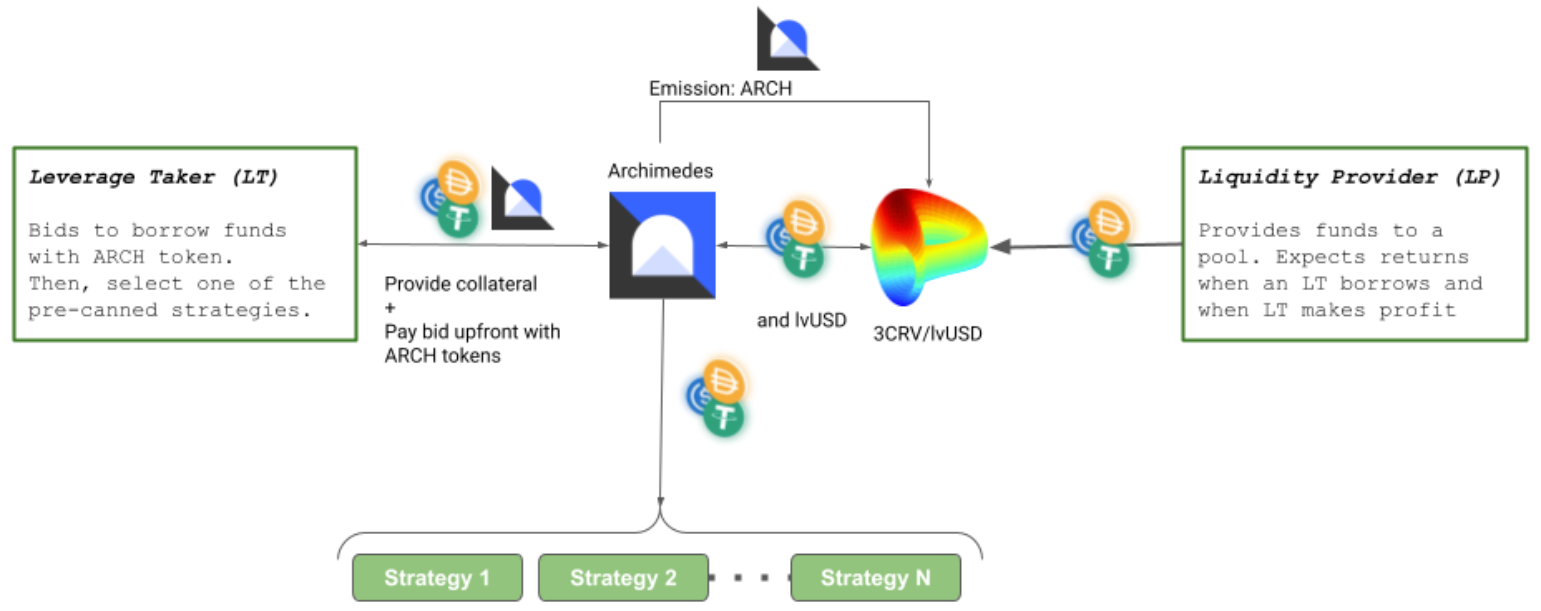

LPs deposit 3CRV to the Curve Factory Pool: 3CRV/lvUSD and receive their rewards as emissions on the pool. This includes upfront interest payments in ARCH tokens and potentially other tokens in the future.

4.1.1 What is lvUSD?

The stablecoin lvUSD is pegged to the USD and is used for lending and repaying loans.

When liquidity providers (LPs) deposit 3CRV, Archimedes borrows lvUSD on behalf of leverage takers (LTs) and uses it to enter a strategy. Investing in the 3CRV/lvUSD pool gives LPs exposure to both 3CRV and the collateral provided by LTs. This allows the market to decide on the best investment strategy.

Here is an example: Let assume Archimedes supports three assets. Meaning, LTs can take a leveraged position on:

- Asset A: Profits from APY on stablecoins, therefore LTs that take this position believe that stablecoin APY will go up in the future

- Asset B: Profits from general volatility in the market. LTs predict the market to become more volatile.

- Asset C: Profits from ETH price going down.

As liquidity is auctioned, the equivalent 3CRV volume in the Curve pool is swapped for lvUSD and invested in the assets A, B, and C based on the highest bidding LTs. LPs are exposed to lvUSD in the pool, which is backed by a mix of assets A, B, and C. LPs are also getting rewards from the protocol treasury in the form of ARCH tokens and potentially other tokens in the future.

lvUSD is not designed to be a "free flowing" stablecoin. While one can buy it on Curve, it has no intended real use outside of the Archimedes smart contract system.

4.1.2 Is there a time limit on the loans and what happens after the loan expires?

Yes. LT’s position expired after a predefined time period. Position lifetime is set upfront, before LTs bid for the position. Also, LTs can choose to unwind their position before it expires.

When a position expires the funds (principle + profit) are available for LTs to claim.

After the position expires but LT hasn’t claimed yet, all profits (after expiration) are incurred to the protocol (principle + profits before expiration are for the LT to claim). The protocol can also decide to unwind the position, repay loan, return 3CRV to the Curve pool. LT funds are available for LT to claim. The protocol will optimize Curve pool health.

If you have unclaimable funds, there will be a status bar that highlights exactly how much is unclaimed. Simply click the button, approve the transaction, and the funds will be in your wallet.

4.1.3 How does the LP rewards work?

All the rewards is handled via the Curve 3CRV/lvUSD pool’s gauge. The gauge will reward LPs with ARCH tokens from the protocol treasury, which collects ARCH leverage fees and performance fees from Leverage Takers.

On one side, leverage takers (LTs) buy ARCH tokens to bid for leverage access (more on that later). On the other side, Archimedes rewards 3CRV/lvUSD LPs with ARCH. This gives LPs control over their own funds in that LPs can sell ARCH in the open market to LTs that are looking to get leverage. As long as an LP is in the pool, they get ARCH emission (more on that later).

Other than ARCH fees and token emission, Archimedes can potentially use the Curve Gauge to distribute some of the profits LTs make on their positions. These profits will be distributed in the form of the strategy's original token (e.g.: some kind of 3rd party stablecoin).

4.1.4 What is the APY on the 3CRV/lvUSD pool? How do you protect ARCH and its utility?

Liquidity providers (LPs) on Curve are looking at the total APY on the pool they provide liquidity to.

The 3CRV/lvUSD pool APY is a key factor in determining how attractive Archimedes is for LPs. This APY is a mix of the protocols treasury which is made up of ARCH and potentially any other tokens coming from the Leverage taker fees. Therefore, we need to define an ARCH emission schedule that intends to address common pitfalls.

The main concern is destroying the token's value and utility by emitting too many tokens early. This drives extremely high APY and attracts more investors. But, leads to higher sell pressure on the token, as everyone wants to cash out on unsustainable APY levels, which puts the entire protocol's ecosystem at risk.

On the other hand, emitting too few tokens can result in an unattractive APY relative to the market, which can dry out the pool and leave no funds available for leverage.

Our solution is a dynamic emission schedule. The goal is to emit enough ARCH tokens to maintain an attractive APY, while adjusting token emission based on APY on other benchmark pools.

- “Target APY” is calculated based on the a predefined source (e.g.: Defillama data)

- * If ARCH price isn’t available on Coingecko, the algorithm will use ARCH/ETH Uniswap pool data and Coingecko’s ETH/USD (taking the last 7 days average ETH/USD price).

Every week, the algorithm calculates the ARCH emission, which is allocated to the 3CRV/lvUSD Curve pool gauge. The emission amount is calculated as per the following formula:

* Note: Emission might be calculated on a weekly basis instead of biweekly.

4.1.5 How to ensure that LPs can exit the pool?

3CRV/lvUSD is a standard Curve Factory pool. LPs can enter and exit like they would with any other Curve pool. The most important factor is maintaining the lvUSD peg to avoid slippage. As long as lvUSD keeps its peg, LPs can enter and exit without incurring significant slippage.

The protocol uses the following mechanisms to maintain the peg:

- Leverage is capped: We limit how much LTs can borrow at any time. Archimedes opens a new auction when there is enough liquidity in the pool. Each auction is for a limited amount of leverage and is designed to maintain the balance of the pool. It serves as a safety mechanism and it creates healthy competition over leverage.

- lvUSD >> $1: If lvUSD rises above $1, Archimedes will raise the leverage cap. More lvUSD will be borrowed and enter circulation, returning the lvUSD peg back to around $1.

- lvUSD << $1: If lvUSD drops below $1, LTs have an arbitrage opportunity by unwinding their position. LTs will pay back $1 worth of debt for less than $1, pocketing the instant arbitrage profits. This process burns lvUSD and increases the amount of 3CRV in the pool.

- Underlying asset losses peg: lvUSD is over collateralized by the underlying assets. In case the underlying asset loses its peg (<< $1), Archimedes automatically closes the LTs’ positions (no penalty to users - this isn’t liquidation, this is closing the position, returning the debt and making the remaining profit available to the LT) . All lvUSD debt is paid back and the borrowed 3CRV returns to the Curve pool.

4.1.6 How does LP know which strategies are included?

The addition of new strategies and underlying assets affects the risk profile of the 3CRV/lvUSD pool. LPs are exposed to the new asset through the pool and also gain the upside of the new asset in terms of the fees collected from the new asset and increased LT activity.

New assets are added after a DAO vote and Archimedes announces the timeline of when they will become active. LPs can then decide whether to adjust their pool investment accordingly.

Voting right is reserved for ARCH token stakers. We expect to see protocols “bribing” ARCH token stakers, so they vote to include the protocol as part of the Archimedes portfolio. That could create an ecosystem where new protocols are put under community scrutiny and compensating ARCH stakers for considering the protocol.

4.1.7 How is leverage allocated to different strategies?

Archimedes aims to automatically optimize LP proceeds by allocating leverage to strategies that LTs find attractive and are willing to pay the most for.

Another way it does this is through the "ARCH wars". We believe that the partner protocols will incentivize LPs to push for greater leverage allocation to their protocol. As the primary recipients of ARCH emission, LPs can influence which strategy their funds are allocated to.

4.2 The Leverage Takers (LT) Side

LTs can choose from pre-canned leveraged strategies. They pay LPs for the amount of funds they want to borrow and provide collateral when opening a position. The protocol then acts on their behalf, borrowing the funds from the Curve pool, creating a leveraged position, and giving LTs an NFT representing their position.

4.2.1 What do LTs provide to the protocol?

In practice, LTs send ARCH tokens and the appropriate collateral asset to Archimedes. The ARCH token is used to pay LPs upfront through an auction process, and the type of collateral required depends on the selected strategy. For instance, using OUSD as leverage would require OUSD as collateral.

4.2.2 What is sent out of Archimedes back to LTs wallet?

Archimedes creates a leveraged position for LT. Instead of sending lvUSD back to LT's wallet, Archimedes does all the leverage building work and LT receives an NFT.

This NFT represents their position. The collateral is assigned to the NFT and remains in the protocol, allowing for full tradability of the NFTed position.

4.2.3 How does the auction work?

The auction uses a variation of a Dutch Auction, we call a "G(r)eek Auction".

Archimedes sets an initial price for leverage, which determines how much lvUSD can be borrowed with 1 ARCH token. It also allocates a specific amount of lvUSD for the auction round, which is divided between different assets and strategies. When LTs take all the lvUSD, the auction is closed and no more positions can be opened.

Each block, the purchasing power of ARCH tokens increases, allowing to borrow slightly more lvUSD per ARCH token. LTs can choose to wait or buy in. If they wait, someone else may take all the available lvUSD.

If they buy in, they need to provide ARCH for the amount of lvUSD they want to borrow. When LTs provide ARCH, they also provide collateral. The protocol then borrows lvUSD on their behalf, swaps it for 3CRV on Curve, and creates the leveraged position.

The mechanics of a “G(r)eek Auction”

At the beginning of every Leverage Round (“Greek” Auction), we start with a pre-set purchasing power for leverage, measured as how many X lvUSD (or OUSD) 1 ARCH can buy.

The initial ARCH Purchasing Power (A.P.P.) X will then increase every block at a fixed rate r, until it reaches a top purchasing power or leverage is fully taken, whichever happens first.

The formula can be summarized as: A.P.P.(t) = X + r * t

- X being the initial A.P.P., measured in lvUSD

- r being the rate in which purchasing power increases (or price of leverage decreases)

- t being the time interval after which A.P.P. increases, measured in hours

Notice that we did not mention the price of ARCH token itself (i.e. 1 ARCH cost $2.00 USD for example), but rather how much leverage 1 ARCH token will grant the user access to. The cost of 1 ARCH token in USD, similar to its cost in ETH, will vary depending on the market.

4.2.4 What is the difference between strategy and position?

Position is an “instance” of a strategy. Strategy includes the following parameters:

- Which underlying asset we leverage

- Leverage multiplier

- Fees

- Position lifetime

- Collateralization rate (underlying asset to lvUSD ratio)

- Force close rate (what are the conditions that will force close the position).

4.2.5 What is “force close”?

“Force close" occurs when a strategy determines that the collateralization rate between lvUSD and the underlying asset is too low. In this case, the protocol will automatically and unilaterally unwind the position to protect the health of the ecosystem. There is no penalty for the LT in this situation and they can claim their collateral and any profit they may have made.

4.2.6 What are the protocol fees?

The protocol takes fees for originating the lvUSD loan and for performance based on profits (if any). The fee amount varies between strategies.

4.2.7 Why NFT?

NFTs are used for positions because each position has different characteristics and is non-fungible. This includes a different lifetime and amount of collateral.

Additionally, using the ERC-721 standard means that LTs may be able to trade their positions on a third-party NFT marketplace. Positions may be traded at a premium due to the scarcity of leverage, or provide another way to exit a position in case of issues.

4.2.8 Claiming Rewards

Users can exit their position at anytime prior to expiry. Upon expiry, the user will see a status bar with a button that reads the exact amount of claimable funds from the expired position. If unclaimed and the strategy has expired, the position is no longer earning yield.

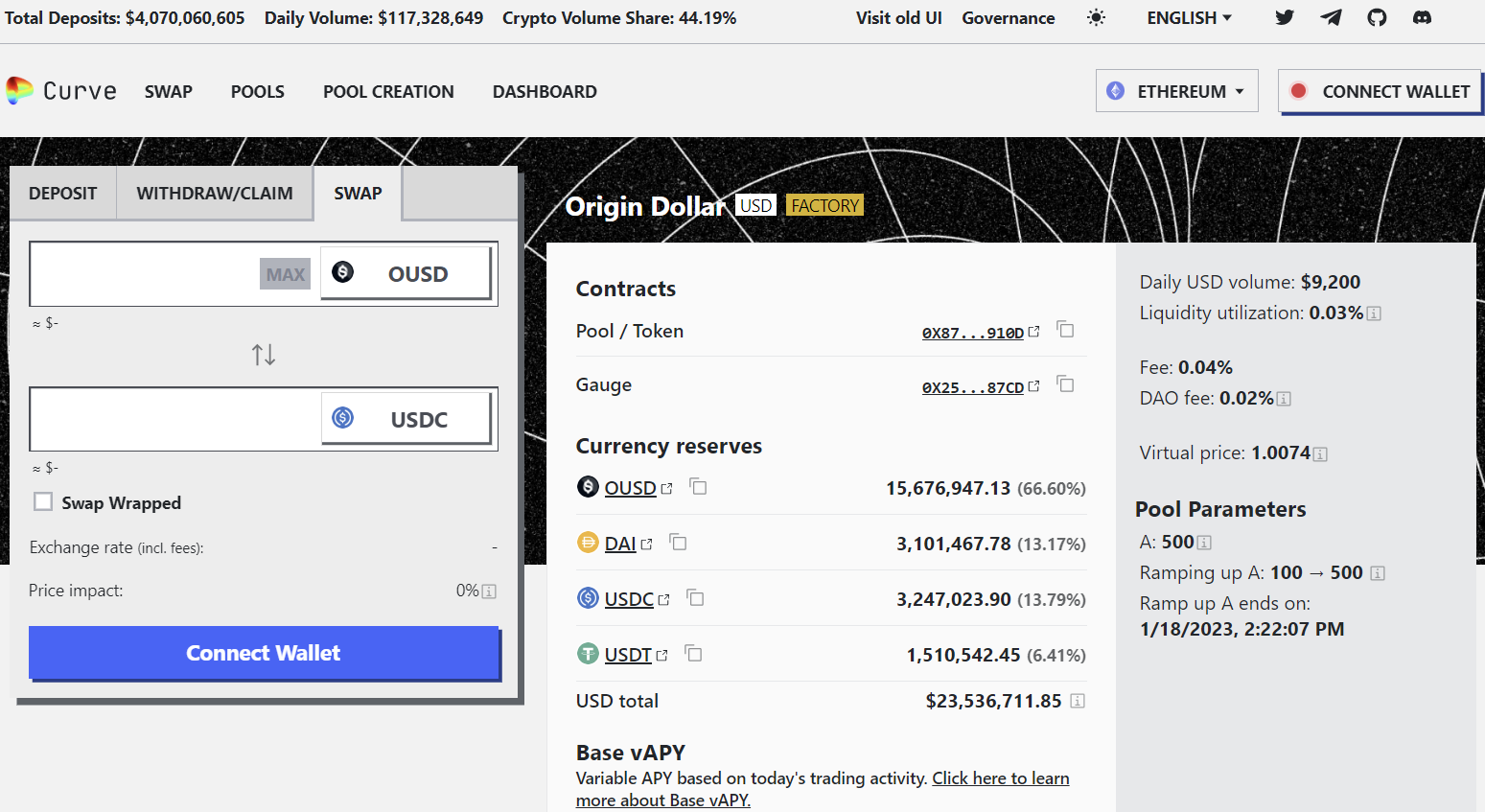

Rewards + Collateral are returned to the user in the form of OUSD. Although this will not always be true, for now, users can exchange OUSD for USDC on Curve if they do not wish to hold OUSD or redeposit. There is plenty of liquidity to work with.