Introduction

TL;DR Protected Single Pools allow users to deposit a single asset (like ETH or USDC) and earn yield through a single strategy that is monitored off chain for risk and efficiently compounds rewards. This allows users to earn high yield from liquidity pool strategies while knowing the protocol will automatically withdraw when risks like pool balance and TVL don’t look right. Users earn higher yield on a single asset while knowing their risks are monitored.

Archimedes' Protected Single Pools (PSPs) streamline yield earning in DeFi. Designed for those keen on maximizing yield from assets like ETH, USDC, or BTC. PSPs shield users from the typical risks of liquidity pools and tracks their holdings in their deposited asset.

Key Features

- Single Asset Deposits: Users are facilitated to deposit primary assets, including but not limited to ETH or USDC.

- Strategic Monitoring: PSPs employ funds in pre-selected pools. These pools are under the continuous surveillance of the Offchain Monitor, which performs a series of Health Checks block by block, ensuring real-time risk assessment.

- Risk Mitigation: The Offchain Monitor is proactive in preventing potential value depreciation from pool imbalances. It is constantly making decisions on whether to withdraw funds with the intent of protecting the user’s principal amount.

- Gas Usage Efficiency: Archimedes has optimized operations to ensure minimal gas expenditure for the user. This includes automated collective withdrawals during pool discrepancies and reward compounding, ensuring users are not burdened with excessive gas fees.

- Yield Optimization: Our system is structured to compound rewards frequently, ensuring users consistently receive optimal yields.

Archimedes’ PSPs aim to combine the benefits of high-yield strategies with the assurance of trust and protection. This approach allows users to explore the advantages of liquidity pools while being shielded from significant risks, such as impermanent loss and potential security breaches.

TL;DR Archimedes provides a way for users to deposit a single asset and get higher yield by using high yielding liquidity pools and compounding the rewards while protecting the assets, saving users time spent on constant monitoring of the pool and managing rewards.

Benefits

Why deposit with Archimedes?

- Archimedes guards whitelisted pools from price divergence automatically removing liquidity when pool imbalances are detected. This keeps our user’s funds safe and means they do not have to monitor the pool themselves.

- Rewards are compounded efficiently meaning funds are earning yield more often and gas costs are socialized across the whole pool meaning your yield won’t be lost to gas and you can benefit from more often compounding.

- Users will deposit and withdraw in a single asset simplifying the experience of getting yield in an LP position with fewer transactions and different asset exposure. Rewards being compounded also means more assets are in your base asset rather than withdrawing 2+ pool tokens along with reward tokens that you then have to swap.

- Rest easy! Know the position is being monitored by Archimedes

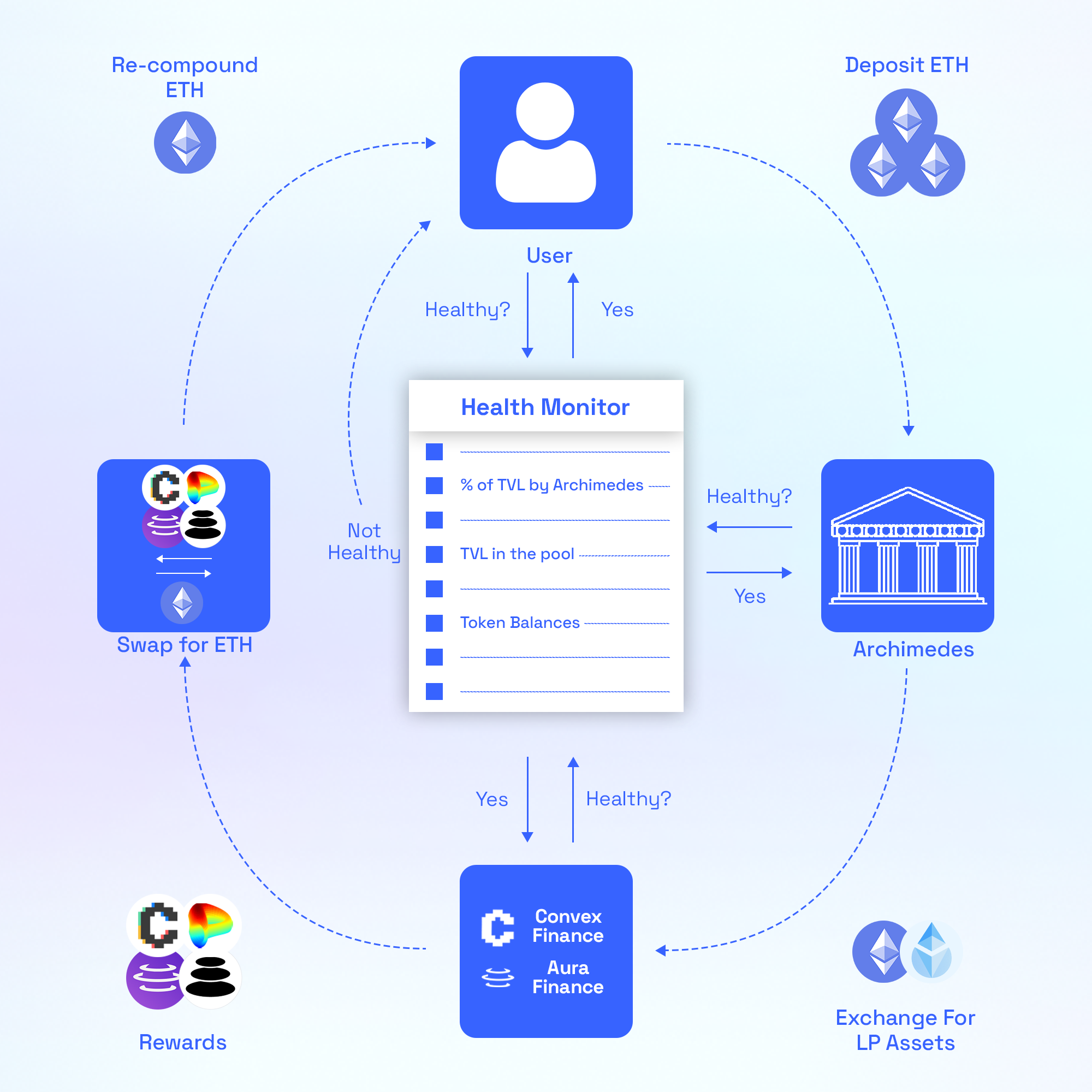

The above graphic outlines the journey of a users funds during and after a deposit into Protected Single Pools. At all stages of this process, the Health Monitor is live, checking if Archimedes user’s funds are safe or not.

Monitor Health Checks

Health Check | Threshold | Value |

Total Value Locked | $1M | Pools have enough assets to verify some value, pools can’t be easily manipulated, Archimedes can deposit significant value |

Archimedes Control | 33% | Archimedes can act as a single entity and withdraw all assets in one transaction, we don’t want to have a significant impact on the pool or be left holding an outsized amount if others suddenly withdraw |

Pool Balance | Variable | For each type of pool, these values can be very different with the goal of not allowing price impacts on a maximum withdrawal at below a certain threshold depending on the risk profile of the strategy. |

Slippage (Pegged pools) | Variable (usually 1-2%) | When providing liquidity to a pegged pool, LPs usually have on token they see a “value” and the rest of the tokens are “risk”. Basically, LPs are seeking APY on “value” tokens, they deposit “value” tokens to the pool and want to make sure they can always exist the pool without loosing “value” token.

For example: Provide ETH as liquidity to ETH/xETH pool. Collect APY, and automatically leave the pool when the amount of ETH reduces and slippage increases. |

How it Works

How Archimedes Protected Single Pools Operate:

- User Deposits: Users deposit a preferred base asset, such as USDC or ETH, aiming to earn yield.

- Asset Deployment:

- It then takes the user's asset and, if necessary, swaps it for the appropriate asset type.

- This asset is then deposited into the whitelisted liquidity pool in battle tested a Decentralized Exchange such as Curve or Balancer.

- Subsequently, the liquidity pool position is deposited into a reward aggregator, such as Convex or Aura.

- To ensure gas efficiency, these steps aren't immediate. Instead, deposits are grouped, and transactions are batched, ensuring both efficiency and funds availability for withdrawals.

- Continuous Monitoring:

- Archimedes' Offchain Monitor consistently checks the pool for various metrics: Total Value Locked (TVL), asset balance, the percentage of the pool owned by Archimedes, and most importantly the slippage upon exiting the pool at that moment in time.

- In the future, the system can be enhanced with additional health checks to safeguard assets further.

- Asset balance thresholds are tailored for each pool type. For instance, an ETH deposit in a Curve Stableswap pool of ETH/xETH will have different parameters than a USDC deposit in an 80/20 Balancer pool of USDC/ETH.

- Yield Maximization:

- As the deposited assets generate yield, the monitor identifies optimal moments to claim rewards.

- These rewards are swapped back to the base asset and redeposited into the primary pool. This process ensures that rewards also generate yield, and users' exposure to tokens like CRV and BAL is reduced.