Introduction

If you've journeyed with us since our v1 days, you'll remember our initial traction with leverage on stablecoins. Now, in v2, leverage remains at our core and it's evolved based on the invaluable lessons from our early days. Our primary drive? Sustainability.

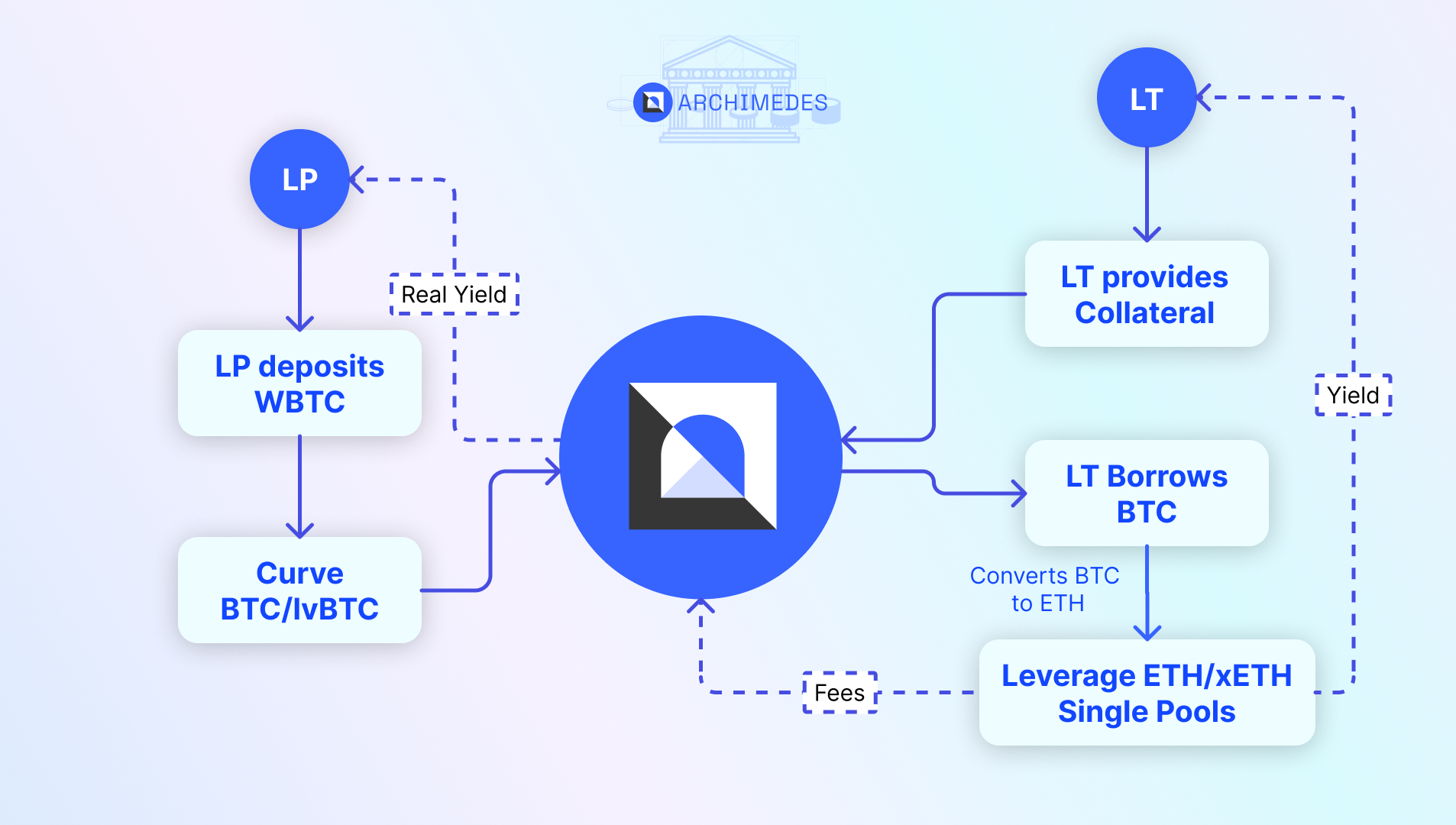

With our revamped v2, we've crafted a leverage model that benefits everyone in the ecosystem. Liquidity Providers (LP), Leverage Takers (LT), and the Protocol all without relying completely on ARCH token emissions. Users can expect top of market yields and returns in the assets that they care about.

How Archimedes Leverage Works

The Basics

At its core, leverage in Archimedes allows users to amplify their potential returns. This is achieved by borrowing assets to increase the size of their position. How do we ensure this system is sustainable and beneficial for all?

For Liquidity Providers (LPs)

1. Depositing Assets: As an LP, you deposit your WBTC into the WBTC/lvBTC Curve pool (this will take many forms in the future as we expand to new chains 😉) . This pool acts as the primary reservoir of funds that will be borrowed and leveraged by LTs.

2. Earning Yields: In return for your deposit, you are paid for providing this liquidity and facilitating other users to borrow WBTC. Depositors will be paid out from the yield and fees generated by the LTs who are leveraging the assets provided. More on this later.

UI/UX for lending COMING SOON

For Leverage Takers (LTs)

As a leverage taker, you are borrowing the lent asset and swapping (if necessary) to the other assets needed to deposit into the strategy of your choice. For example, if you’re interested in leveraging a position in the ETH/alETH strategy, you will be borrowing WBTC and swapping this for ETH / alETH. This effectively opens a short position on WBTC and a long position on ETH/alETH.

Graphic COMING SOON

1. Providing Collateral: Before you can leverage, you need to provide collateral in the form of ETH, WETH, USDC, or WBTC. This collateral is then multiplied by the multiplier you select to calculate the exact amount of assets you will be borrowing.

2. Borrowing and Earning: Once your collateral amount and multiplier are chosen, your borrow amount will show right above the Approve button. These borrowed assets will then be deposited into the specific strategy the user has chosen to leverage.

3. Free liquidity → Share profits: As we all know, no liquidity or service is free. To make the protocol sustainable, LTs must share a portion of profits. A variable performance share is taken from profits and is split amongst WBTC depositors. This is subject to change based on Archimedes DAO proposals.

Specific fees for each pool can be found on the Strategies page.

Position Liquidation

Let’s face it, nobody likes liquidation but its a necessary evil for most leverage products. At Archimedes, we want user positions to stay healthy and liquidation is used our last resort safety mechanism, triggered when a leveraged position's value declines significantly compared to the borrowed amount. Specifically, if the total value in BTC (collateral, borrowed BTC, and profit) dips beneath the BTC debt plus a set Liquidation Buffer, the position is flagged for liquidation.

Graphic COMING SOON

To determine liquidation, Archimedes simulates the unwinding of user positions every block to decide whether there is enough collateral, after unwinding, to keep lenders whole plus a buffer. Unlike traditional lending platforms like the Aave model, Archimedes does not transfer custody of lent funds to the leverage taker but rather entitles them to the rewards and returns of those funds.

Now, that being said, there are protection mechanisms in place that make this event unlikely to happen for the majority of LTs. You can learn more about the protected pools here Protected Single Pools. Depending on the strategy and the users leverage multiple, the automated guardrails will trigger and exit positions before they have the chance to be liquidated. This is not guaranteed and liquidation is still a risk.

Only a designated role within the protocol, the Monitor, can initiate this process. Upon liquidation, the position is converted back to BTC. If the returned BTC is less than the outstanding debt and the Liquidation Buffer, the protocol settles the BTC debt, deducting a minor fee mostly for transaction costs. Any remaining BTC can be retrieved by the leverage taker. If the BTC doesn't fall below the set threshold, the liquidation attempt is nullified.

For more information on how to open a position go to

The Protocol's Role

1. Matching Borrowers with Lenders: Archimedes acts as the intermediary, ensuring that LTs can easily borrow from the pool of assets provided by LPs.

2. Risk Management: The protocol has built-in mechanisms to monitor the health of leveraged positions and their underlying strategies. If a position becomes too risky either from a collateral stand point or a strategy health stand point, the protocol can initiate measures like liquidations and/or automated guardrails to protect both LPs and LTs.

For more information about protection, head over to Protected Single Pools

3. Yield Strategies: Archimedes offers a range of yield-generating strategies that LTs can choose from. These strategies are designed to maximize returns while managing risks.

For more information about protection, head over to Strategies

4. Auto-compounding: The protocol automatically accumulates users rewards from underlying strategies, redeems them for ETH or USDC, and re-compounds them back into the strategy. During this process is when fees are removed. Our compounding contract only compounds when it makes financial sense to, meaning that rewards will only be compounded when gas prices to fulfill all transactions are significantly lower than the rewards. This will not be much of an issue on L2s but its an important piece of information for mainnet.

Sustainability: Beyond Token Emissions

While many protocols rely heavily on token emissions to reward their users, Archimedes has designed a system where the primary rewards come from genuine defi economic activities. This ensures that the rewards are sustainable in the long run and not just based on inflating token supply.

Rewards

Understanding "Real Yield"

The "Real Yield" is the genuine return LPs can expect, derived from the WBTC borrowed from the WBTC/lvBTC pool. This yield is unique as it's generated without relying on token emissions.

The protocol produces a compelling real yield for LPs using the WBTC borrowed from the WBTC/lvBTC pool. By minting lvBTC tokens, the protocol borrows WBTC, which then funds high-yield strategies for Leverage Takers (LTs). These strategies maximize returns by navigating various pools for the best yields, with built-in measures to ensure risk management.

To safeguard LPs, LTs provide collateral when borrowing. If a leveraged position's value falls below a certain point, the protocol intervenes. In the event of substantial losses, the LT's collateral covers LPs before using the pooled WBTC, ensuring LPs benefit from high yields with minimized risk. The yields from LT strategies are shared between LPs and LTs, with the protocol fostering a balance of incentives to provide LPs with a high-yield, low-risk environment.

Liquidity as a Service

Archimedes Finance has established partnerships with various protocols to enhance the APY. These collaborations bring in additional incentives, either through direct "Real Yield" assets or secondary tokens that can be swapped for such assets. These partners will help boost rewards to lenders and/or leverage takers depending on the partnership.

Reward Distribution

Rewards are distributed through the Curve Gauge (or equivalent gauge) associated with each pool. The protocol charges LTs a performance fee, which is then allocated to the Curve WBTC/lvBTC pool Gauge as additional rewards for LPs.

Claiming Rewards

Archimedes aggregates all user deposits of the funds within one strategy to a vault. This vault is a contract that automatically facilitates claiming, compounding, depositing and withdrawing. Rewards are claimed from each strategy on a weekly or bi-weekly basis, depending on the asset type of the underlying strategy.

Protocol Mechanics

The “Minter” Role

Within the Archimedes Finance ecosystem, there's a specialized role known as the "Minter." This role has the unique privilege of minting new lvBTC tokens. The Minter sends these tokens to predefined, whitelisted WETH vaults used for lending. This role is crucial for adjusting the amount of WBTC borrowed based on the protocol's needs and pool balance.

Strategy Share Vault

When you, as an LT, open a leverage position, the protocol directs the borrowed WBTC into your chosen yield strategy. Instead of transferring any assets externally, the protocol retains the resulting strategy shares within the Strategy Share Vault. This internal custody simplifies the management and closure of leveraged positions and protects both the protocol and LPs from incurring any potential bad debt.

Grace Period

To maintain security of lvBTC, LP assets, and the protocols health, a grace period on LT positions are very important. Archimedes reserves the right to close any leverage positions after 21 days of the deposit date. This does not mean we will expire the position but rather that we reserve the capability to do so. As a protocol, we wish to keep all user positions open and we only expect to close positions to keep the WBTC/lvBTC pool healthy for liquidity providers.

Important Note: More technical details such as contract addresses coming soon

Protocol Fees

Fees vary per strategy due to different asset types and risk profiles. All fees are subject to change based on Archimedes DAO governance proposals and resolutions.

- Performance Fee: Charged on the yields from leverage positions.

- Liquidation Fee: Applied if a position is liquidated. More on this coming soon

- Exit Fee: 2.5% Charged on profits when an LT voluntarily closes a position.

Important Note: No exit fees are taken from any positions that are expired by the protocol after its 21 day grace period.

Administration

There are a few administrative tools that you should be aware of as the user and participant of the Archimedes DAO.

- Setting WBTC Quotas: Archimedes DAO can set borrowing limits per strategy and for the entire protocol.

- Whitelisting Strategies: Only approved strategies can be utilized for leverage positions. This approval process will pass through governance and then implemented after approval from the Archimedes DAO.

- Setting Position Lifetimes: Archimedes DAO determines the maximum duration for leverage positions to mitigate risks.

- Liquidation Parameters: Archimedes DAO tunes the liquidation buffer threshold and fee to balance risk management and position viability.

- Pausing Contract: In an emergency, authorized members can pause protocol operations. This provides a kill switch if needed.

Technical Details

Details like contract addresses, upgradability, events, timelocks, and roles will be provided in subsequent sections.

lvBTCFAQ

What is the WBTC/lvBTC pool?

How do I earn yields as a Liquidity Provider (LP)?

What does "leveraging" mean in this context?

How is my deposited WBTC protected?

What happens during a "liquidation"?

Are there any fees involved?

How does the protocol ensure sustainability?

Can I withdraw my WBTC anytime?

What is the role of the "Monitor" in the protocol?

How does the protocol decide which yield strategies to use?

Docs are under construction

Archimedes is an experimental protocol and carries significant risks: Smart contract risk, economic model risk, risk that the assets Archimedes introduces and many other types of known and unknown risks.

Archimedes' team never provides investment advice. This article is NOT financial advice. DYOR.

Participate at your own risk.