Warning: Archimedes is not yet live and therefore the offerings described in this document are not accessible to users yet. Do not fall for scams!

Summary:

What You’ll Need:

- DAI or USDC or USDT - You will need to deposit one of these assets as liquidity to the pool. You can purchase any of these on Curve.fi or 1inch.io

Note: Liquidity Provider positions will need to be created and managed on the Curve.fi platform and NOT on Archimedesfi.com. The Curve.fi platform is battle-tested over time but as with all platforms in Defi, it has inherent risks and you should always DYOR

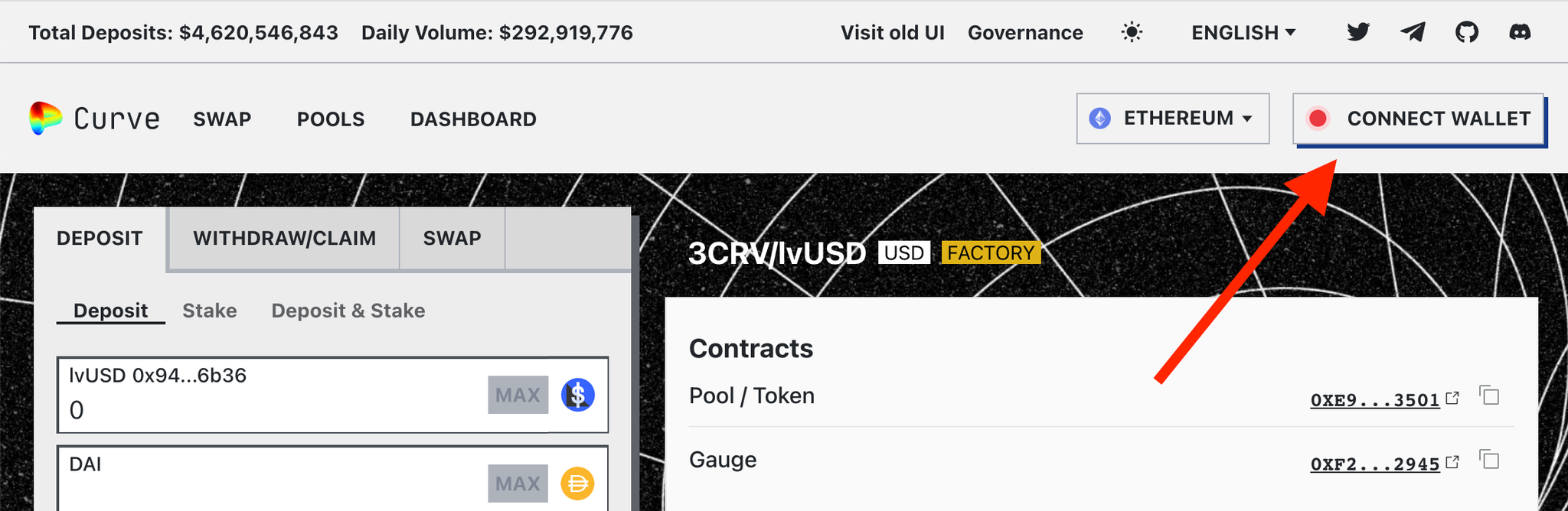

Step 1: Go to the ‘lvUSD’ page and Connect your wallet

- Please go to our pool page here on Curve

- Connect your Metamask wallet. (you can create a wallet following these steps Here)

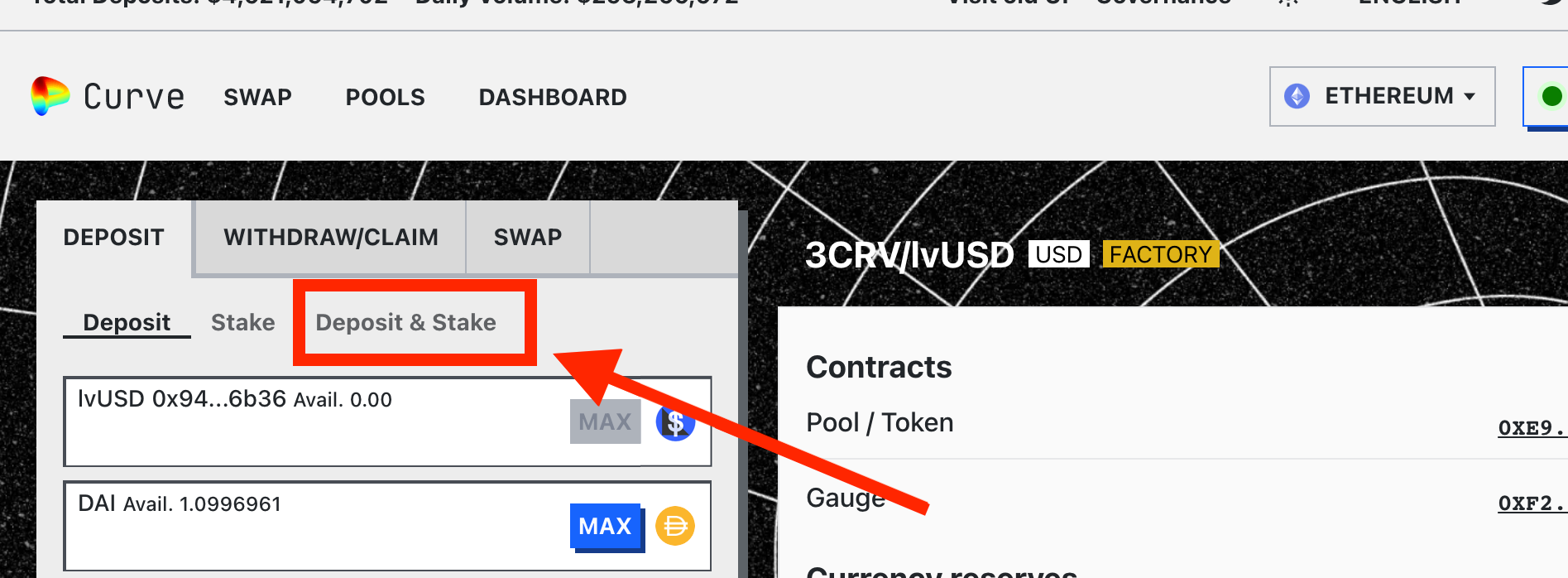

Step 2: Deposit Liquidity

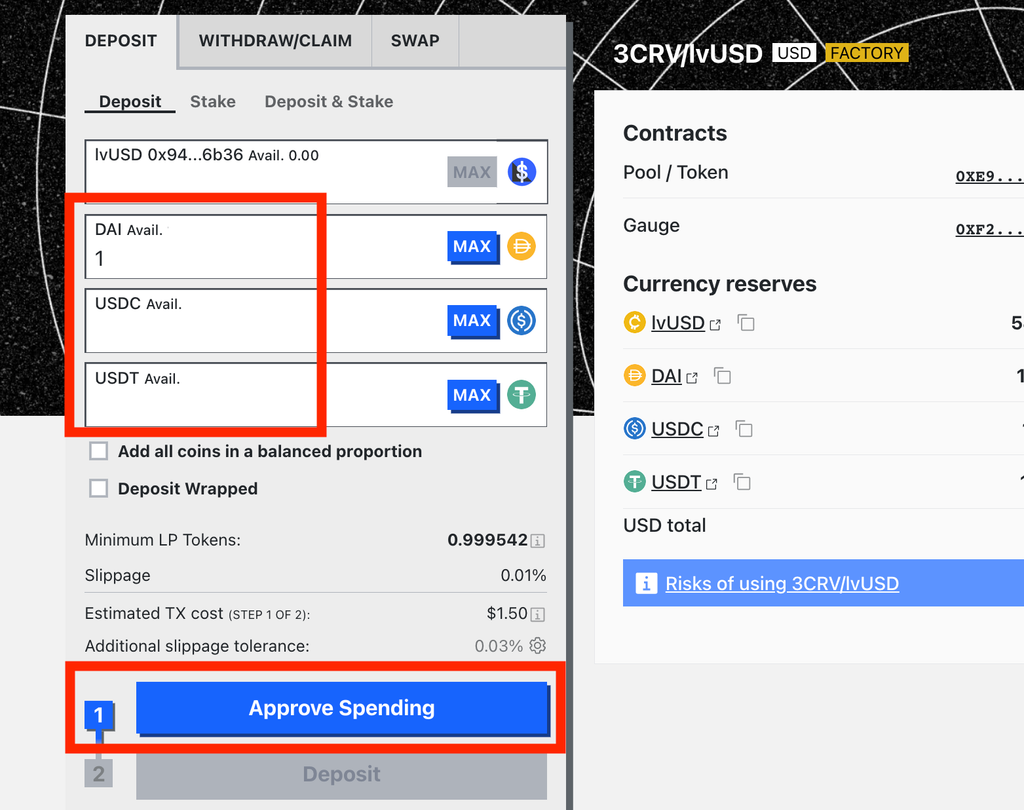

- Click on the “Deposit & Stake” tab

- Enter the desired amount of DAI, USDC or USDT you want to add to the lvUSD Curve pool.

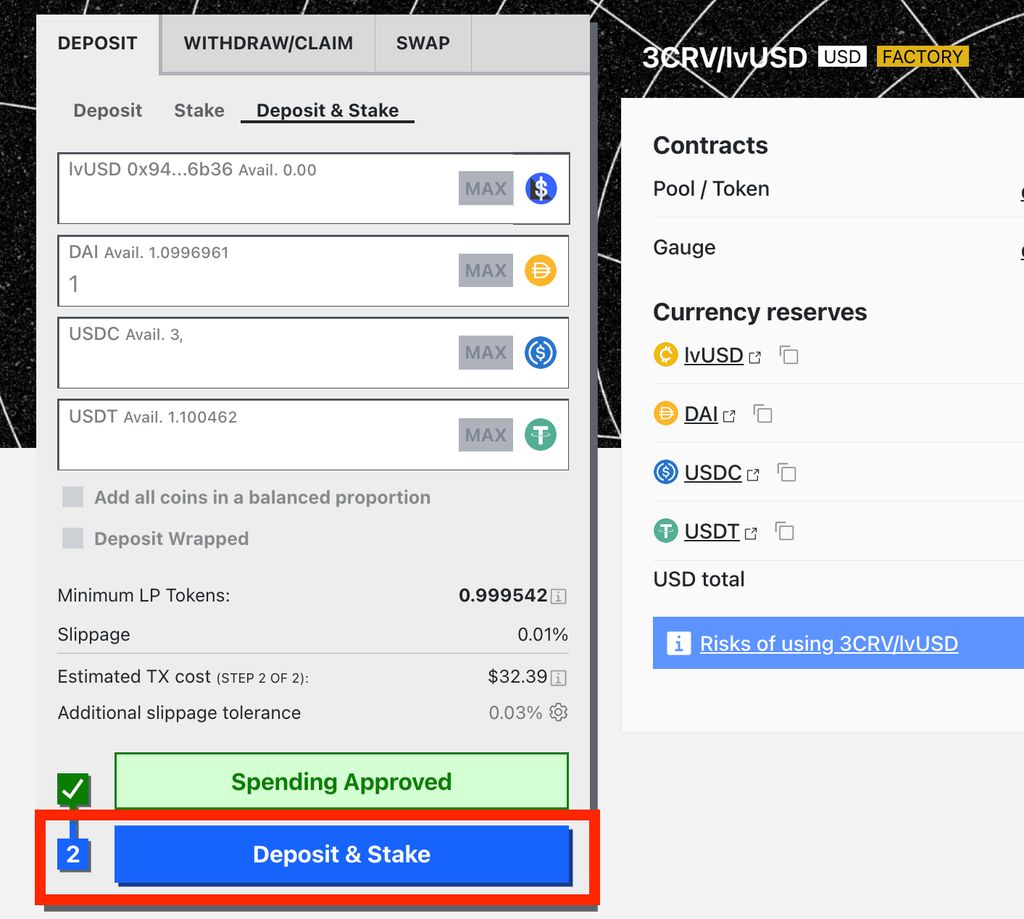

- Click “Approve Spending”. You will need to confirm this in your Metamask wallet

- Click “Deposit & Stake”

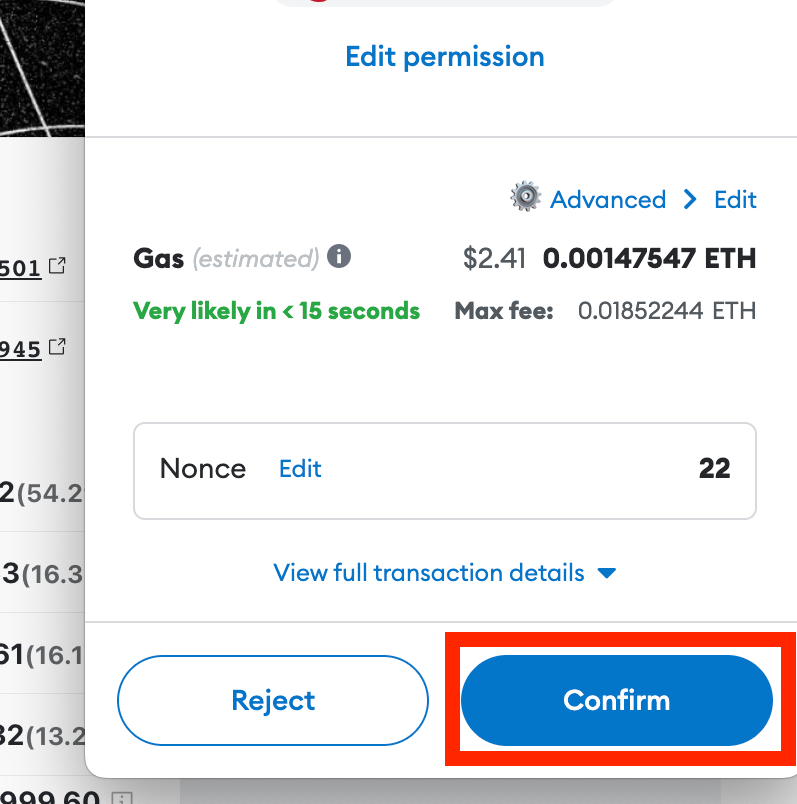

Step 3: Approve in your Metamask Wallet

- Your Metamask wallet will popup multiple times for approval

- Please click ‘Confirm’ each time the popup window opens

Step 4: That's it. Claim Rewards

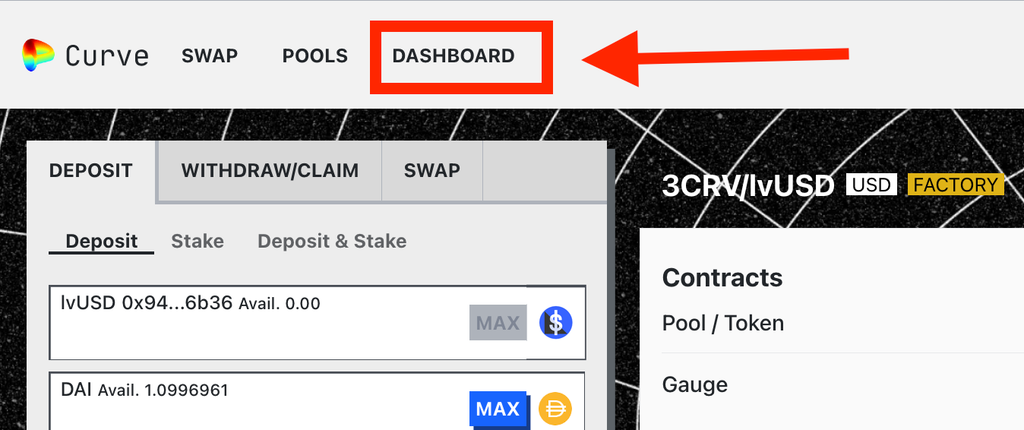

- Monitor Position: You can monitor your position and your rewards by clicking on the Curve ‘My Dashboard’ here:

- Claim Rewards: You can claim your rewards here on this page: https://curve.fi/#/ethereum/pools/factory-v2-268/withdraw

- Monitor the Pool: You can also monitor the health of the Pool on our Dune Dashboard here.

FAQ

Do I need to complete Approvals in the Archimedesfi.com platform also?

- No, all actions and management of your pool position can be done within Curve.fi

Archimedes is an experimental protocol and carries significant risks: Smart contract risk, economic model risk, risk that the assets Archimedes introduces and many other types of known and unknown risks.

Archimedes' team never provides investment advice. This article is NOT financial advice. DYOR.

Participate at your own risk.