Past and Future Leverage Rounds

- The latest Leverage Round parameters and details will be posted here on Twitter

- Also be sure to follow us on Discord, Twitter, Medium and Telegram to keep updated about new and ongoing Leverage Rounds.

How Does It Work?

Archimedes makes Leverage (lvUSD) available when our 3CRV/lvUSD Curve Liquidity Pool increases by a set amount. When you open a position the price you pay for the Leverage (lvUSD) will be higher at the start of a Leverage Round and it lowers in price over the proceeding days until all the leverage has been acquired.

We conduct the following process for Leverage Rounds:

- We announce a new Leverage Rounds and the allocation amount prior to leverage being available. Please follow us on Discord, Twitter, Medium and Telegram to stay updated about new and ongoing Rounds.

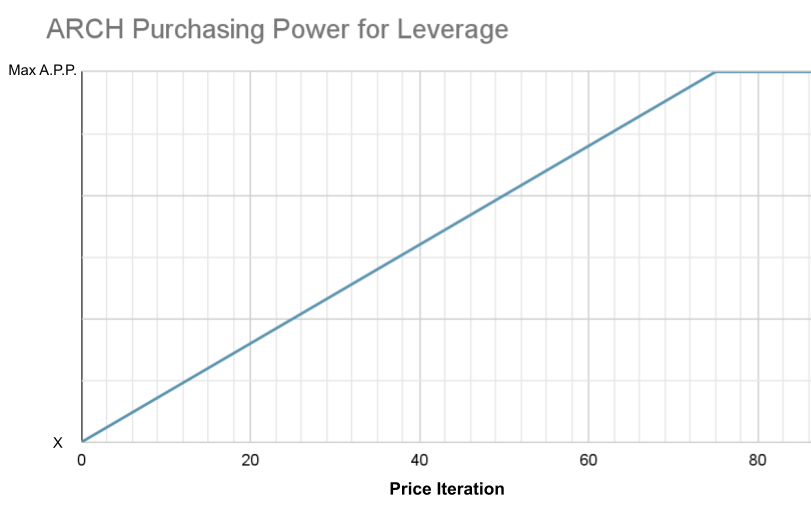

- When the Leverage Round begins, the initial price of lvUSD will start at a higher set price, or similarly, the ARCH Purchasing Power (A.P.P.) for leverage will start at a lower value. Here is a hypothetical example:

- Let’s assume 1 ARCH = 150 lvUSD

- This refers to how much lvUSD (leverage) that 1 ARCH can buy.

- The ARCH Purchasing Power (A.P.P.) for Leverage increases at a fixed amount over time. Here is a hypothetical example:

- A.P.P. may increase by 10 lvUSD every 1 hour for 3 days until a set cap A.P.P. is hit.

- Purchase price will then remain at the set cap A.P.P. value until all available leverage (lvUSD) is acquired.

- The user can decide to accept the current Leverage A.P.P. and simply open a position, or wait for purchase power to further increase. But of course, they then run the risk that leverage will sell out and no longer be available.

- If users acquire all the available leverage you will need to wait for the next Leverage Round to open a position.

The ARCH token that users provide to get access to leverage is collected in our treasury and those funds are then used to compensate the Lenders (Liquidity Providers to the Archimedes’ Curve 3CRV/lvUSD).

Users are not bidding for and receiving a transferrable lvUSD token. They are simply deciding whether or not to open a leveraged position at the current cost of leverage (lvUSD).

The Mechanics of a Leverage Round: The G(r)eek Auction

At the beginning of every Leverage Round, we start the G(r)eek Auction with a pre-set purchasing power for leverage, measured as how many X lvUSD 1 ARCH can buy.

The initial ARCH Purchasing Power (A.P.P.) X will then periodically increase at a fixed amount r, until it reaches a top purchasing power or leverage is fully taken, whichever happens first.

The formula can be summarized as:

A.P.P.(t) =X+r*t

With:

- X being the initial A.P.P., measured in lvUSD

- r being the amount in which purchasing power increases (or price of leverage decreases)

- t being the time interval after which A.P.P. increases, measured in hours

Notice that we did not mention the price of ARCH token itself (i.e. 1 ARCH cost $2.00 USD for example), but rather how much leverage 1 ARCH token will grant the user access to. The cost of 1 ARCH token in USD, similar to its cost in ETH, will vary depending on the market.

We announce the exact details about new Leverage Rounds and the allocation amount ahead of time. Please follow us on Discord, Twitter, Medium and Telegram to stay up to date.

Archimedes is an experimental protocol and carries significant risks: Smart contract risk, economic model risk, risk that the assets Archimedes introduces and many other types of known and unknown risks.

Archimedes' team never provides investment advice. This article is NOT financial advice. DYOR.

Participate at your own risk.