Emission rates remain subject to change depending on market conditions, subject to DAO approval any given time.

MotivationARCH Token Dynamic Emission ScheduleAnnual ARCH Emission GuardrailsThe Yearly Emissions Schedule

Motivation

Traditionally, the two main sources for Curve pool rewards are:

- CRV rewards: These are a nice bonus, but by itself it limits the Protocol’s ability to reward and retain Liquidity Providers (LPs) in the long term as the access to CRV emissions are becoming scarcer, more competitive, and expensive - mainly for new protocols.

- Governance token emission: Protocols typically use a fixed emission schedule of their governance token for their liquidity mining programs. In these, most protocols set a fixed emission schedule to emit tokens to a Curve pool, initially driving high APYs, which quickly falls as TVL grows. But since the emitted token normally has no real utility and LPs benefit from short lasting high rewards, there is a strong sell pressure from LPs wanting to cement their high rewards, reducing the value of the token. As a consequence, those once stellar APYs become small to insignificant, posing doubts about the sustainability of the token and the protocol.

ARCH has utility and it is a ticket to leverage. This creates buy pressure, but that might not be enough to oppose any potential sell pressure.

To protect the health of ARCH tokens, we use a cutting-edge token emission design, in addition to our future Real Yield approach.

ARCH Token Dynamic Emission Schedule

In our approach, we adjust ARCH emission to reward our liquidity providers periodically by using an algorithm that keeps APY in a specific range. The Archimedes protocol’s emission rate is dynamic in order to provide competitive APY at different market scenarios and conditions. This prevents over inflation of token supply, and protects both the token value and the protocol.

Archimedes calculates the ARCH emission volume weekly based on the ARCH price and a target APY based on top pools and market APYs.

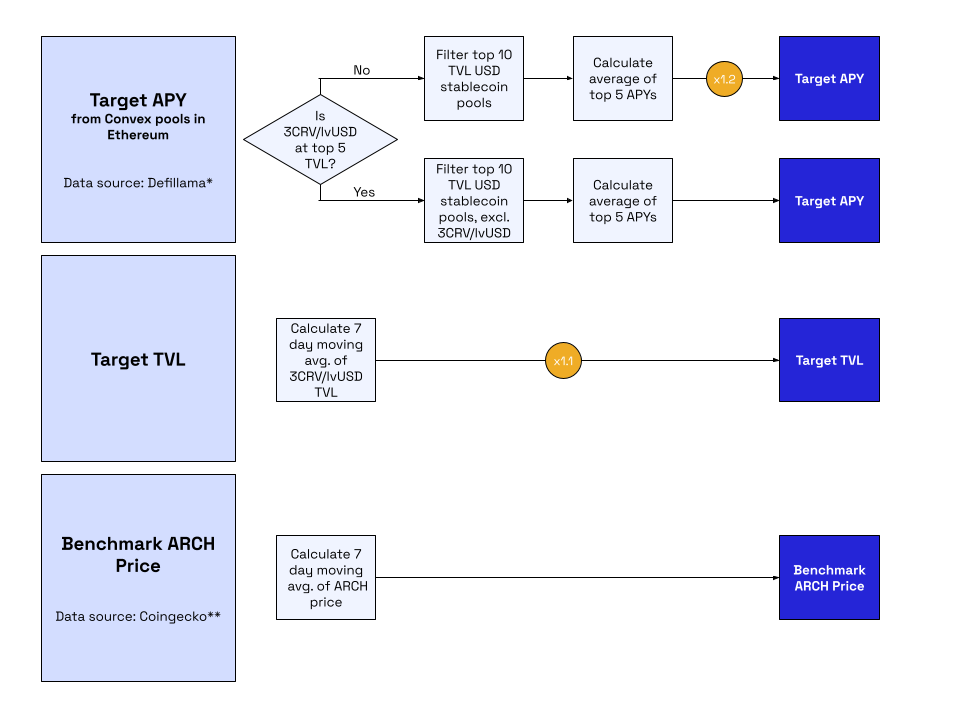

The algorithm will first calculate a few parameters a the image below shows:

Every week, the algorithm calculates the ARCH emission, which is allocated to the 3CRV/lvUSD Curve pool gauge. The emission amount is calculated as per the following formula:

Annual ARCH Emission Guardrails

For every year, the algorithm sets a minimum and maximum emissions to avoid edge cases, i.e. what we call emission guardrails. Otherwise significant drops in ARCH price or other unexpected event might drive ARCH to overinflate.

The way the guardrail enforcement happens is:

- The guardrails are defined on weeky basis such that a large volume of the annual allocation is not emitted early on.

- A simple division of the annual quota across 26 emission periods would still allow large emission at the early stages of the project. To avoid that, weekly limits are calculated and determined for both weeks 1-26 and weeks 27-52 periods.

The Yearly Emissions Schedule

The min and max ARCH emissions by period (starting Feb 20th) until Year 4 are defined as below and are subject to change based on historical data for Year 2+ and/or upon DAO approval for any period:

Year 1

The total max annual emission is set to 6,718,878 ARCH and the minimum is 335,944 ARCH for Year 1.

Years 2-4

We plan to key off of the two 26 weeks periods of Year 1, and gradually increase the min and max.

Years 5-10

From Year 5 on, we determine the max annual emission by calculating the amount of ARCH left to emit divided by 5. We’ll then use the same formula used in Year 1 to determine the actual emission amount every two weeks. If by the end of year 10 there is still ARCH supply to be emitted, we’ll emit all left supply in a single two weeks period.

Archimedes is an experimental protocol and carries significant risks: Smart contract risk, economic model risk, risk that the assets Archimedes introduces and many other types of known and unknown risks.

Archimedes' team never provides investment advice. This article is NOT financial advice. DYOR.

Participate at your own risk.