How it worksThe ARCH tokenThe lvUSD tokenArchimedes PoolsARCH Token distributionToken addresses and supply + pools addressesARCH SupplylvUSD SupplyLearnings from current industry practices

How it works

The ARCH token

ARCH is Archimedes’ Utility and Governance token.

Here, we discuss only the utility of the ARCH token.

In every financial system, there is no such thing as infinite leverage. In other words, leverage is scarce.

At Archimedes, funding for leverage is coming from our Curve pool. To gain access to leverage a Leverage Taker (LT) needs to get a “ticket to leverage”. This is done with our utility token - ARCH.

Through an auction, the market sets the amount of leverage 1 ARCH gives access to. The more demand to leverage the more demand for ARCH.

On the LP side, the protocol distributes ARCH tokens to our Curve LPs. They lend the funds, thus they hold the "ticket to leverage" and LTs need to buy ARCH from LPs. This means LTs pay for leverage upfront.

It’s worth noting that:

- We limit the lifetime of the loan. It closes itself after the position lifetime period ends. Upon lifetime closing event, the borrower will need to claim their rewards with Archimedes.

- There are no ongoing interest payments on the loan through its lifetime.

The lvUSD token

lvUSD is a synthetic USD pegged stablecoin. lvUSD represents “potential leverage”. The protocol borrows it from LPs to lend it to LT's, and swaps it with 3CRV, which is then swapped with OUSD to gain leverage.

The Archimedes’ loan is always fully collateralized and everything takes place inside the protocol, so that collateral never leaves the Archimedes vault.

Archimedes Pools

We do not build our own pools. Instead we use Curve and Uniswap to host both of our pools:

- 3CRV/lvUSD on Curve supports lending and borrowing.

- USDC/ARCH on Uniswap is a market for ARCH.

Both Curve and Uniswap are battle tested and well known. Archimedes has no control over these pools, which means they are completely permissionless.

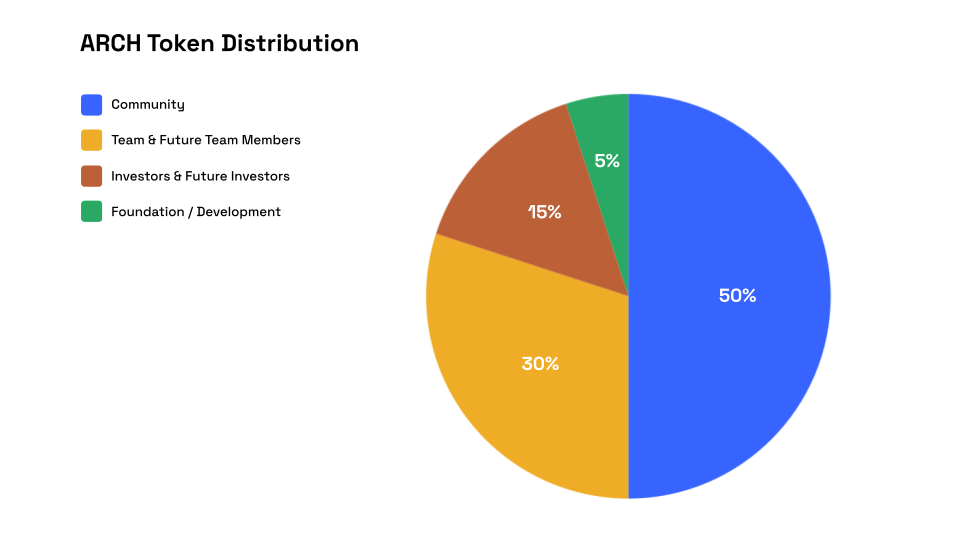

ARCH Token distribution

Distribution is still being finalized and is subject to change prior to launch.

- 50% Community: Liquidity mining incentives. More on it to follow

- 30% Team and future team members: one year cliff with total three linear vesting

- 15% Investors and future investors: one year cliff with total three linear vesting

- 5% Foundation/Development program: development cost, audits, service provider, OPEX and partnerships

The current distribution plan is - subject to change:

Token addresses and supply + pools addresses

ARCH Supply

- Total Fixed Supply: 100,000,000 ARCH. All preminted to our treasury to support dynamic emission schedules and experimenting with the correct way to conduct leverage auctions.

- 0x73C69d24ad28e2d43D03CBf35F79fE26EBDE1011

lvUSD Supply

- Flexible supply based on protocol rules.

- 0x94A18d9FE00bab617fAD8B49b11e9F1f64Db6b36

Learnings from current industry practices

CRV emission is capping Curve ability to scale

Curve is the capstone of DeFi and without Curve there is no stablecoin market and no liquidity on DeFi. This is why we chose to build on top of Curve and support it.

Fixed CRV emission is limiting Curve scaling ability. All Curve pools, together, share the same CRV emission. As more investors and projects use Curve, each liquidity pool $ gets a smaller share of CRV. Since 95%+ of APY is from CRV emission, there is a limit to how much liquidity CRV (and Curve) can support.

We see this as an opportunity to support Curve and the DeFi ecosystem. Archimedes aims to be one of the few pools that doesn’t rely on CRV emissions to create an attractive APY. That means we are going to help Curve scale. We expect an “overflow” of liquidity into Archimedes’ pool from liquidity that CRV emissions cannot support.

We see Curve hitting the “CRV growth barrier” while we continue to grow with Archimedes pools.

Overinflating and deteriorating token value

We all have seen practices of a “naive” emission schedule for liquidity mining programs in DeFi. The general sequence of events is usually:

- Set a fixed emission schedule.

- Emit far too many tokens to a Curve pool, driving APY to atmospheric levels.

- Since the emitted token has no real use yet, investors dump it.

- The higher the APY the faster the dump to capitalize on the high APY.

- Token value is deteriorated and protocol future is in question.

ARCH token is different from other protocol tokens: it has utility as the "ticket to leverage". But that is not the only thing we count on.

To protect the health of Archimedes protocol, we use a dynamic emission schedule. In other words, we adjust ARCH emission to our Curve pool periodically. We use a predefined formula that keeps APY in a specific range. More on the dynamic emissions here soon.

This prevents overinflation of token supply, and protects the protocol. The mechanism creates a healthy pace of growth by attempting to offer APY that is inline with other top pools.

Out of balance pools

3CRV/lvUSD is in the heart of our protocol. But, if we allow unlimited leverage, we are going to throw the pool out of balance and de-peg lvUSD. To mitigate that we cap leverage.

Every time we have excess 3CRV in the pool we open a new leverage auction. LTs can then bid and pay for leverage up to a limit as we cap the available leverage to maintain pool balance.

Also, there are two depegging scenarios to consider:

- If lvUSD depegged above 1 USD, we’ll open more leverage. Lending 3CRV out of the pool returns lvUSD back to ~1.

- If lvUSD depegged below 1 USD, it incentives LT to close their position and take immediate profit. They buy lvUSD out of the pool adding 3CRV for less than $1 for 1 lvUSD. Then they pay off $1 worth of debt with that, pocketing the difference.

Underlying assets deppegs

If one of the assets we build on loses peg, we have another tool. Force close position.

When the collateral rate falls below a predetermined threshold, we unwind positions. There is no penalty to users and no incentive to invoke that - it is a protocol service. We repay the lvUSD debt, and expect investors to be able to claim their principle + all the profits.